Electric vehicle iron core is the main component used to support and fix the motor coil in electric vehicles. It is usually made of high-performance electrical steel sheets with special permeability and permeability to optimize the efficiency and performance of the motor. The main function of electric vehicle iron core is to provide a stable magnetic circuit, so that electrical energy can be effectively converted into mechanical energy. When the current passes through the coils of the motor, the resulting magnetic field creates a magnetic flux in the iron core. The design and material selection of the core can minimize the loss of magnetic flux, thereby improving the efficiency of the motor.

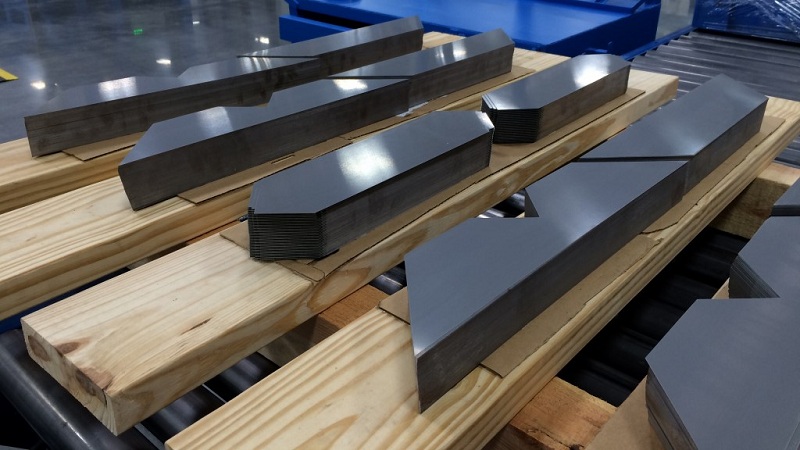

In order to achieve this goal, electric vehicle iron core usually adopt a laminated or stacked structure, consisting of many sheets or sheets. This design can reduce the eddy current loss in the iron core, increase the path length of the magnetic flux, increase the magnetic resistance, and thus reduce the magnetic flux leakage loss. In addition, the core usually has a special shape and groove to accommodate the coil and ensure that the magnetic field can be efficiently transmitted between the rotor and the stator.

With the rapid increase in sales of new energy vehicles, the automotive industry's demand for drive iron core is growing rapidly, and consumers' requirements for motors continue to increase, manufacturers use electrical steel, amorphous alloys, soft magnetic ferrite and other materials to improve the performance of the motor. The size of China's automotive iron core market reached $551 million in 2022 and is expected to reach $1.299 billion in 2029, with a compound annual growth rate (CAGR) of 13.74%. Overall, China's automotive iron core industry is a rising industry, because its downstream electric vehicles are expected to grow faster, we are expected to usher in greater growth in the future automotive motor core industry.

From the perspective of product type and technology, the iron core is growing fastest, with a market size of 21.95 million US dollars in 2022 and is expected to reach 60.18 million US dollars in 2029. Welded iron cores account for the highest proportion, with a market size of $321 million in 2022, accounting for 58.21% of the total automotive motor iron core market.

From the perspective of product market application, pure electric vehicles account for a relatively high proportion, and the market size in 2022 accounts for 75.02% of the total automotive iron core market. The research team believes that hybrid electric vehicles are transitional products and will be gradually replaced by pure electric vehicles in the future, but the sales performance of hybrid models in 2021, The proportion of hybrid electric vehicles began to increase, which is mainly because the hybrid technology of domestic manufacturers is becoming more mature, and is widely recognized by consumers. It is expected that in the next few years, the current replenishment problem and range anxiety of pure electric vehicles will still exist, and hybrid models will still maintain a high growth rate, but with the solution of the above problems, pure electric vehicles will eventually become the mainstream.

From a regional perspective, the market size in East China accounts for the highest proportion, reaching 48.37% in 2022, followed by South and North China. This is because the Yangtze River Delta, with Shanghai as the center, has always been an open gateway to China, and the developed hydraulic transportation is also the first choice for many foreign investors. Many overseas product giants have opened Chinese factories here to achieve localization construction and expand their market in China. On the other hand, there are also many automotive industry factories in this region, which also gave birth to the supply and demand of the local automotive iron core industry, and cultivated a large number of enterprises, such as Tesla, SAIC, NiO and so on.

At present, domestic manufacturers form an alternative trend to foreign manufacturers, thanks to the rapid development of domestic new energy vehicles, more and more enterprises choose the products of local enterprises to replace, and domestic manufacturers have experienced the process of catching up to the leading, forming a domestic alternative to Japanese and Korean manufacturers. However, some joint venture car companies will still choose to cooperate with foreign manufacturers due to the supply chain structure, and foreign manufacturers will continue to occupy market share in China in the future.

In-Depth Analysis of Global Supply and Demand for Silicon Steel

2025-10-30Influence of iron core stress on performance of permanent magnet motor

2024-01-09Asian stainless steel market gains further momentum

2023-04-17Technological Innovation and Application of Transformer Cores in the Context of Smart Grids

2024-12-18Stainless steel surface treatment process- beadblasting

2020-10-20Main Uses & Application Fields of Stainless Steel Water Tank

2022-08-01