Technological trends: thin specifications, low iron loss, and high strength, becoming the mainstream direction in the future.

Driven by the dual factors of demand upgrading and intensified competition, the technological development direction of non-oriented silicon steel has become very clear: thin gauge, low iron loss, and high strength. These three characteristics directly determine the market competitiveness of the product.

1. Thin-gauge: The core choice for lightweight and high energy efficiency

Thin-gauge non-oriented silicon steel (such as 0.27mm and below) can significantly enhance the lightweight level and energy efficiency conversion efficiency of motors, making it a mainstream means of reducing iron loss. Taking new energy vehicles as an example, the market share of non-oriented silicon steel with specifications of 0.27mm and 0.25mm used in automobiles will exceed 57% in total by 2025. Although the current commercial utilization rate of specifications below 0.2mm (such as 0.18mm and 0.15mm) is low, it is expected to achieve rapid growth from a low base, becoming a "core material" in cutting-edge fields.

2. Low iron loss: The key to reducing energy consumption and motor risks

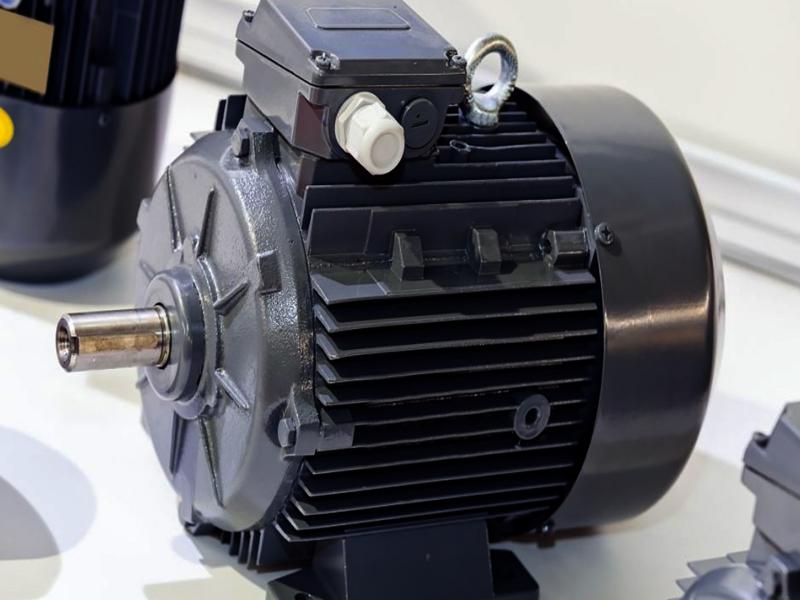

Low iron loss can reduce electric energy loss during motor operation, minimize motor temperature rise, avoid the risk of permanent magnet demagnetization, and enhance energy utilization efficiency. With the widespread adoption of high energy efficiency standards such as IE4, low iron loss has become a "basic requirement" for non-oriented silicon steel. In the future, enterprises need to further reduce iron loss values through component optimization and rolling process upgrades.

3. High strength: rigid requirement for adapting to high-speed motors

The motor speeds of new energy vehicles and low-altitude aircraft are getting higher and higher, posing higher demands on the strength of silicon steel - it needs to resist the centrifugal force during high-speed rotor operation, ensure stability, and avoid safety risks such as fracture and cracks. Therefore, high-strength non-oriented silicon steel will become the "standard configuration" for high-end motors and a key focus of corporate technological research and development.

Overseas opportunities: Motor exports remain the mainstay, with three major regions worthy of focused deployment.

1. Europe: Motor exports serve as a "basic pillar", and local production capacity remains reliant on imports

In 2024, China's exports of motors to Europe accounted for 36% of the European market share, with Germany and France being the core destinations (together accounting for 80% of the market). Although Chinese motor companies have begun to establish local production capacity in Europe, the increase in new energy vehicle production capacity in Europe (such as the addition of 10 factories by Volkswagen and BMW) is significant, and the transformation of local motor suppliers' production capacity lags behind, only meeting 60% of the new demand. The remaining gap still needs to be filled by Chinese motors. In the next five years, Europe will remain the main market for China's motor exports.

2. Southeast Asia: An "Engine of Growth" in Emerging Markets, with Chinese Enterprises Driving Demand

Southeast Asia has been the most attention-grabbing emerging market in the past two years, with numerous Chinese-funded new energy vehicle (NEV) OEMs and component enterprises establishing factories here (such as BYD and SAIC Motor), while retaining the habit of sourcing Chinese motors and silicon steel. Despite the gradual maturity of the local industrial chain in Southeast Asia, the proficiency of workers and the completeness of the industrial chain are still inferior to those in China in the short term, making Chinese motors significantly cost-effective. Furthermore, the growing demand for new energy logistics vehicles and medium and heavy-duty trucks in Southeast Asia will also drive the export of commercial vehicle motors, presenting immense potential.

3. South America: Automobile companies take the lead in layout, and the demand for motor imports is yet to be unleashed

Leading Chinese automakers, such as Great Wall and Geely, have already established production capacities in South American countries like Brazil, Peru, and Ecuador, with production expected to commence from 2025 onwards. Initially, the local production scale will be relatively small, and the construction of supporting motor production capacities is lagging behind. Therefore, the South American market will still import motors from China, and it is expected to become another "growth pole" following Southeast Asia in the future.

Why choose Hongwang?

2025-09-18The Center Of Attention--Hongwang Black Ti Series

2023-07-10Hunan Hongwang silicon steel project officially starts production

2023-03-28Hongwang Ranked Chinese Top 500 Enterprises and Manufacturing Enterprises in Year 2023

2023-09-25Hongwang's intelligent made,A stunning appearance at the 133rd Canton Fair

2023-04-23HWHG successfully signed the HuiShan project

2023-12-08