Downstream Demand: Four Key Sectors Drive the Silicon Steel Market

The core demand for silicon steel has always resonated with the development of downstream industries. At present, the demand for non oriented silicon steel is growing, driven by four major fields, among which emerging tracks such as new energy vehicles, humanoid robots, and low altitude economy have become the "main growth force" of high-grade non oriented silicon steel.

1、New energy vehicles: the "super engine" of high-grade non oriented silicon steel

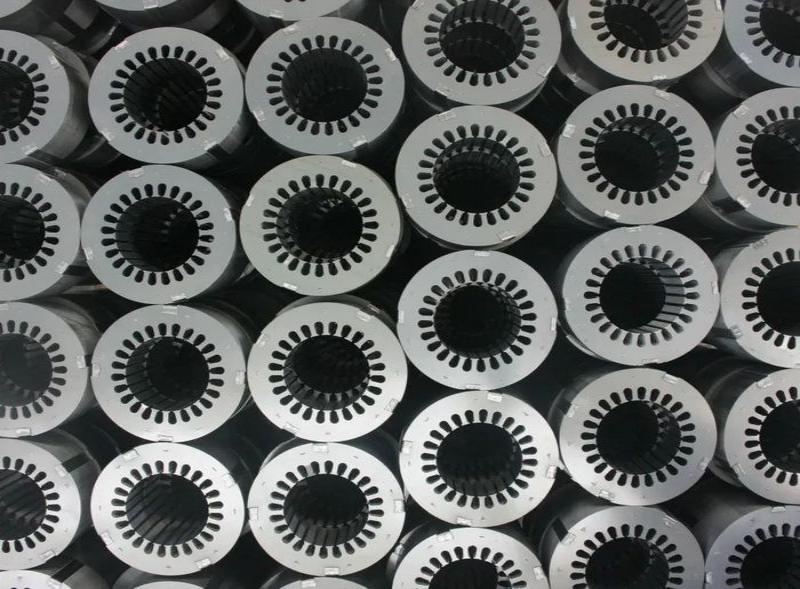

The explosive growth of new energy vehicles has directly driven the demand for high-grade non oriented silicon steel. In terms of usage, each passenger car drive motor requires approximately 45 kilograms of high-grade non oriented silicon steel, while commercial vehicles require up to 100 kilograms per unit, and some models are equipped with 1-2 motors, further increasing demand.

From the perspective of global penetration rate, the penetration rate of new energy vehicles has soared from 4% in 2020 to 18% in 2024, corresponding to exponential growth in demand for non oriented silicon steel. Among them, China is the absolute "main force of demand": in 2024, the sales of new energy vehicles in China will reach nearly 13 million units, accounting for 70% of the global total (this number has exceeded the total sales of new energy vehicles in 2022), directly driving the consumption of high-grade non oriented silicon steel by more than 1 million tons. In 2024 alone, the production of non oriented silicon steel for new energy vehicle brands in China will reach 1.17 million tons.

In other regions, although Europe's growth rate has slowed down due to the reduction of subsidies, it still maintains a market share of over 20%; Emerging markets such as Southeast Asia and Latin America have shown impressive growth rates, with new energy vehicle sales increasing by over 60% in 2024; US sales increased by 10% year-on-year, accounting for 10% of the global total. More importantly, the upgrade of motor technology (high speed, high power density) further amplifies the demand - in order to improve the range and power density, the requirements for high-grade non oriented silicon steel for motors will only be higher. It is expected that the demand for non oriented silicon steel in the field of new energy vehicles will continue to maintain a high growth rate of 17% in the next five years.

2、Industrial motor energy efficiency upgrade: dual wheel drive of stock replacement and incremental demand

Industrial motors are the basic demand field for non oriented silicon steel, widely used in scenarios such as conveyors, water pumps, and household appliances. At present, the global industrial motors are in a dual wheel drive stage of "stock replacement+incremental demand": there are currently 1.5 billion industrial motors in operation worldwide, and in the next decade, they will enter a centralized replacement cycle. The replacement demand alone will drive a large amount of consumption of non oriented silicon steel; The global industrial motor production is expected to reach approximately 1.3 billion kilowatts in 2022, and is expected to increase to 1.6 billion kilowatts by 2025, and further reach 2.7 billion kilowatts by 2030, with the increase mainly in high-end and high-performance products; Various countries have raised their motor energy efficiency standards, for example, the European Union requires that motors launched from 2023 must meet the IE4 energy efficiency standard (with an iron loss value reduced by 20% compared to the old standard), directly promoting the penetration of non oriented silicon steel into high rank and high-performance products.

It is worth noting that China holds a 60% share in the industrial motor market and is the world's largest producer and demander, providing stable demand support for domestic silicon steel enterprises.

3、High end Future Incremental Pool: Humanoid Robots and Low altitude Economy

Shipment volume of humanoid robots in China

The humanoid robots that have exploded in popularity in the past two years are becoming a "new increment" for high-grade non oriented silicon steel. A humanoid robot needs to be equipped with about 50 small and medium-sized motors (controlling joints such as neck, waist, fingers, etc.), which are small in size and require high precision. The magnetic properties and precision requirements of silicon steel far exceed those of traditional motors.

Previously, the specialized silicon steel for humanoid robots relied almost entirely on imports, but now domestic enterprises have broken the bottleneck and achieved independent supply. In terms of sales, the shipment of commercial humanoid robots in China has exceeded 2000 units in 2024, and is expected to exceed 60000 units by 2030, with an average annual compound growth rate of 76%. With the acceleration of application verification under policy guidance (such as commercial scenario trials and robot marathons), the humanoid robot industry is expected to replicate the development path of new energy vehicles and become the next "super growth pole" of non oriented silicon steel.

The Development Trend of China's Low altitude Economy

Although the current demand for low altitude economy (drones, electric vertical takeoff and landing vehicles, flying cars, etc.) is small, the potential is enormous. The motor speed of this type of aircraft far exceeds that of traditional household appliances and industrial motors, and it needs to maintain excellent performance at medium and high frequencies, with a high dependence on high-grade non oriented silicon steel. It is expected that by 2030, the low altitude economy, together with humanoid robots, will contribute significantly to the demand for high-end non oriented silicon steel, becoming a new growth point in the industry.

4、Low carbonization of power structures, transformers, and oriented silicon steel

In addition, the demand for oriented silicon steel cannot be ignored. In 2024, the production of oriented silicon steel in China will be about 2.95 million tons (a year-on-year increase of 12%), with a capacity utilization rate of nearly 90%, accounting for 70% globally, of which private enterprises will account for nearly 50% of the production. However, oriented silicon steel is mainly used in the field of transformers.

Global supply and demand: Asia's oversupply is a foregone conclusion, supply chain restructuring under trade barriers

1、Regional supply and demand differentiation: Asia dominates supply, demand gap in Europe and America needs to be filled

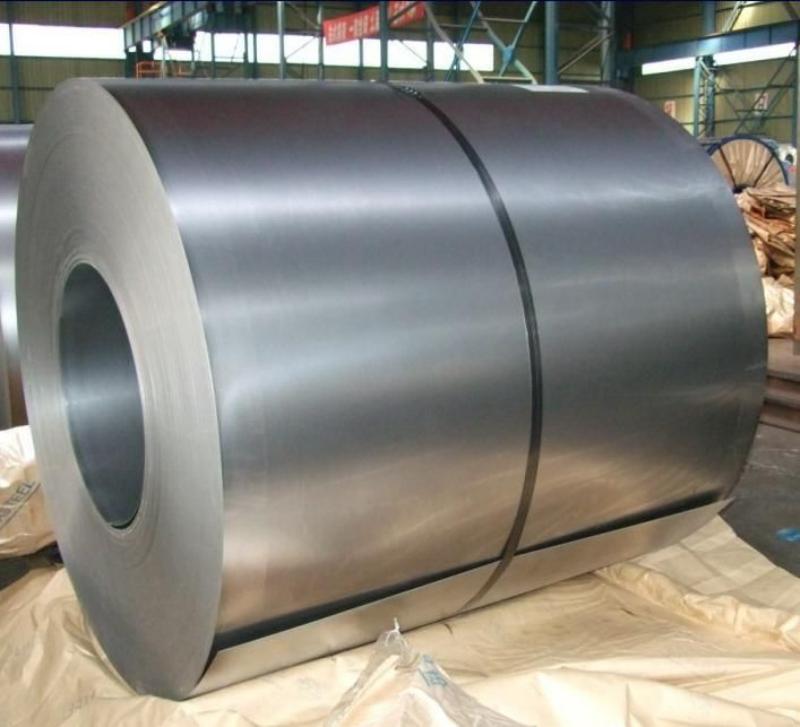

Asia: China, Japan, and South Korea are the core production areas, with outstanding new production capacity increasing. In 2024, China's production capacity of non oriented silicon steel will approach 15 million tons, with a production of 13.15 million tons and a capacity utilization rate of nearly 90%, accounting for over 60% of the global market share; Japan and South Korea (such as Pohang in South Korea) maintain production and sales balance by increasing exports. The supply in Southeast Asia is relatively stable. Although India has plans to increase production capacity, the scale is small. Due to anti-dumping investigations, the import channel has shifted from China to Japan and Taiwan, China. Overall, the situation of oversupply in Asia continues to expand.

Europe: The slower than expected expansion of the new energy industry has resulted in a mismatch between demand for high-grade non oriented silicon steel and supply growth, highlighting the pressure of oversupply. Affected by low-priced imported silicon steel from Asia, European steel mills may push governments to introduce new trade protection measures (such as reducing quotas and raising tariffs), which need to be given special attention in 2025.

Americas: Mainly based in the United States, due to policy adjustments for new energy vehicles, the demand for non oriented silicon steel is weaker than expected, and local manufacturing capacity is limited, with imports still being the mainstay, making it one of the few regions in the world with "supply less than demand".

2、China's supply: from "import dependence" to "export leadership", high-end acceleration

The supply pattern of non oriented silicon steel in China has undergone fundamental changes: in 2024, the import volume decreased by nearly 50% year-on-year, but the export volume reached a new high of 805000 tons, and the export products have been upgraded to high-end products - high ranking products that used to rely on imports can now be exported overseas in bulk.

By 2025, China is expected to add 6 new non oriented silicon steel production lines (with a total capacity of 700000 tons), mainly concentrated in the North and East China regions; Globally, it is expected to add 3 million tons of production capacity by 2025, with a significant increase in the proportion of high-grade and new energy grade production capacity. This means that China's dominant position in the global silicon steel supply chain will be further consolidated, but it also needs to address the challenge of "scale expansion and high-end competition coexisting" - enterprises need to increase research and development investment, seize the high-end market through process upgrades and product differentiation.

3、Short term challenge: 2025 may usher in a period of confusion, accelerating the restructuring of the supply chain

Affected by global political barriers, prevailing trade protection measures, and pressure from capacity release in various countries, the global non oriented silicon steel market may face a brief period of confusion and panic in 2025, with increased uncertainty in customer procurement and steel plant supply. But in the long run, this is also a stage of global supply chain reshuffle, and Chinese companies with technological and cost advantages are expected to occupy a more advantageous position in the restructuring.

Hongwang Silicon Steel coming

2021-12-14Hongwang Technology successfully passed the accreditation of CNAS

2022-12-06The 20 High Rolling mill and BA line put into trial production in Zhaoqing Hongwang

2020-10-30Hongwang Holding Group ranks 451st in the 2021 Top 500 Chinese Enterprises

2021-09-26The Center Of Attention--Hongwang Black Ti Series

2023-07-10Awards of Hongwang QC’s Necessary Items

2021-06-17